I was recently talking to my grandmother about the federal budget and where money was being spent. We looked at the fact that nearly half of the federal budget (47.8% to be exact, totaling $1.9 trillion) is spent on Social Security ($939 billion), Medicare ($591 billion) and Medicaid ($375 billion) (Source).

Today, the Congressional Budget Office that provides nonpartisan analysis for Congress released a report titled “The Budget and Economic Outlook: 2018 to 2028”; basically a 10-year look ahead for Congress on the budget based on current laws.

After reading that report, I wrote her this email:

Good morning Grandma!

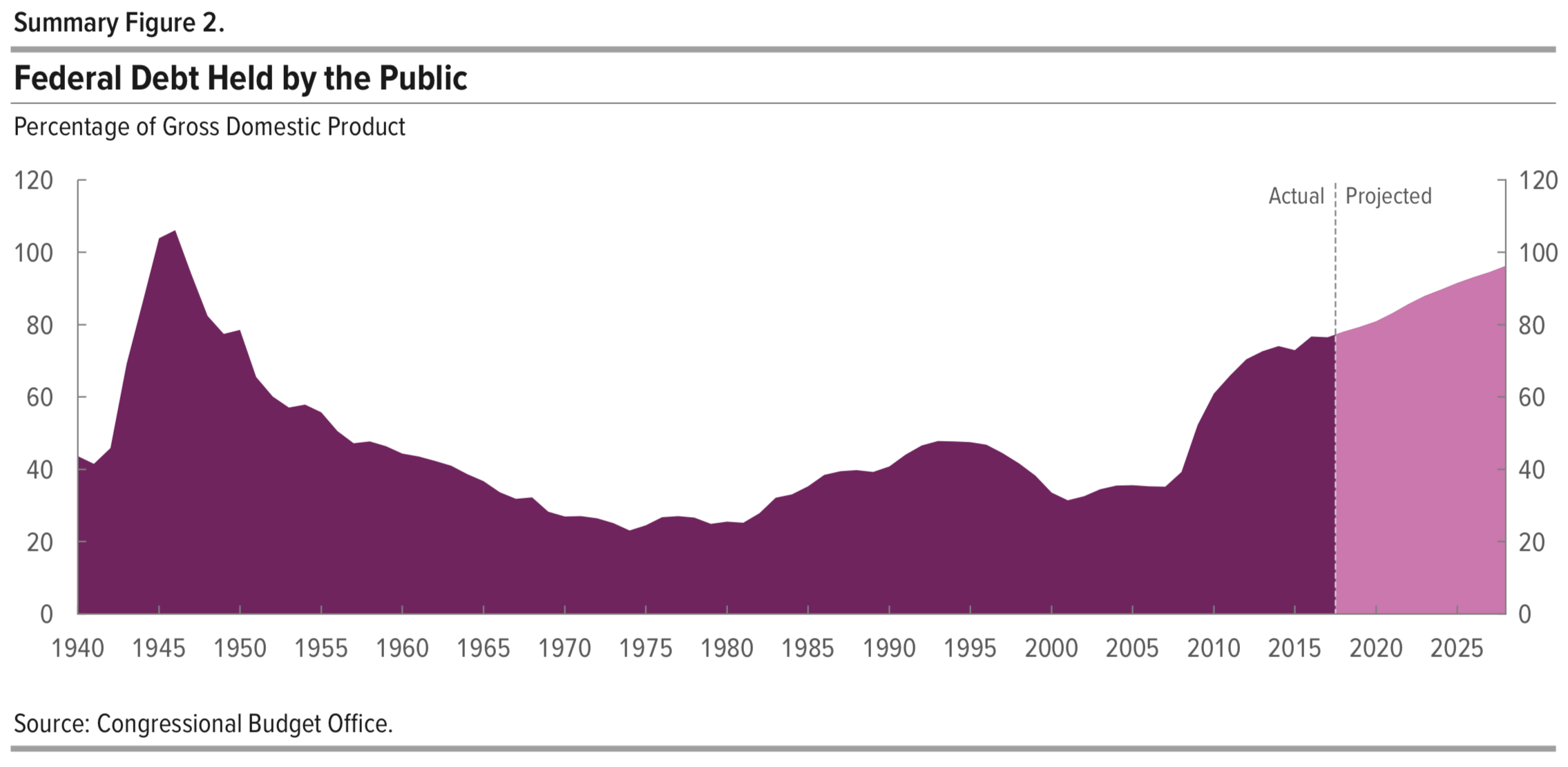

Following up our conversation about the federal debt, I found it interesting to see a new chart that projects forward the amount of national debt for the next ten years based on congressional budgets. The scary part to me is that at some point the debt must be paid (e.g., a 10-year treasury note). The projection is that debt will reach 96% of GDP (Gross Domestic Product - the value of the goods produced in the United States in one year) equivalent to $29 trillion. In other words, if the debt gets to that level, as a country we would have to take 96% of the income we derived from sales that year to pay off our debt. Hard to imagine. Today the debt is $16 trillion. The last time we had debt near 100% of GDP we were at war (1945).

A few notes from the report that I found interesting:

As deficits accumulate in CBO’s projections, debt held by the public rises from 78 percent of GDP (or $16 trillion) at the end of 2018 to 96 percent of GDP (or $29 trillion) by 2028. That percentage would be the largest since 1946 and well more than twice the average over the past five decades (see Summary Figure 2).

Such high and rising debt would have serious negative consequences for the budget and the nation:

Federal spending on interest payments on that debt would increase substantially, especially because interest rates are projected to rise over the next few years.

Remember that our current budget spends nearly 50% on things like Social Security, Medicare, and Medicaid. If we have to increase our spending as a nation to pay back the debt, we necessarily have to cut from somewhere else (e.g., one of those programs)

Because federal borrowing reduces total saving in the economy over time, the nation’s capital stock would ultimately be smaller, and productivity and total wages would be lower.

Lawmakers would have less flexibility to use tax and spending policies to respond to unexpected challenges.

The likelihood of a fiscal crisis in the United States would increase. There would be a greater risk that investors would become unwilling to finance the government’s borrowing unless they were compensated with very high-interest rates; if that happened, interest rates on federal debt would rise suddenly and sharply.

And this last point is interesting because it’s true. The more debt we have (the more debt you and I might have) the riskier it is as an investor to loan us more money. More risk requires a higher potential payout (e.g., I’m not sure if you’re going to pay me back, so I want a high level of return to get back whatever I can). Higher interest rates for people with poor credit is true for car loans today and may be true for our government if our country gets into a situation where we are overloaded with debt (at 96% of GDP). Because ultimately, it’s our tax dollars that fund the government, and it’s the government that has gone into such massive debt.

Oh boy.

-Michael